Pro-AV Business Index

Growth remains tepid through June

Highlights

- The story of a lower growth outlook continues to be supported by lackluster results from the business indices. Though still indicating growth, the AV Sales Index, (AVI-S) remains locked in the high 50-s. Looking across the entire series of the index, most periods prior to 2023 showed scores over 60, other than at the peak of the pandemic in 2020. Thus, one could reasonably expect 2025 growth to come in below the averages of 5-6% for pro AV at large, which is what the newly release forecasts from AVIXA predict. Check those out here -- IOTA FAQ.

Challenges for AV providers still center around the macro context, including inflation, the political situation in the US, and tariff uncertainties, all of which have softened the incoming pipeline of work. The silver lining is that comments suggest the impacts of each have seemed to lessen over the past month or two even if project delays have surfaced. Despite the challenges, growth remains the norm as customers forge ahead with projects, often accepting the increased costs.

With sales growth moving at a slower pace, it is not surprising for the AV Employment Index (AVI-E) to also be tracking lower from a historical perspective. While scores below 60 are more common for the AVI-E, the new reading of 55.6 is still in the lower end of the range even if it increased slightly from May. Given a continuing overall health to the job market, hiring in any sector would remain fairly challenging, with pro AV being no exception. Comments suggest a mix of hiring and downsizing, however, in alignment to budgets and project demand. One might reasonably expect the AVI-E to remain at lower levels as AV companies take a conservative approach to their staffing levels.

International Outlook

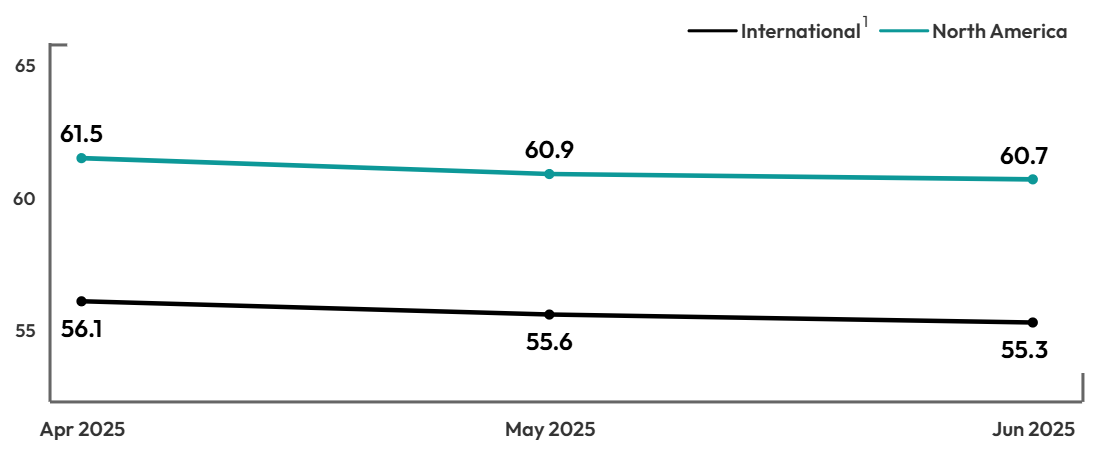

The tolling 3-month averages continue to show North America generating a higher billing result than the rest of the world, at 60.7 and 55.3 respectively. This result runs somewhat counter to the outlook published in the current Industry Outlook and Trends Analysis (IOTA) but may reflect a concentration of responses in some of the slower growth countries outside of North America. This is further supported by the employment index, which suggests a decline for the non-US respondents, at only 49.1, compared to 57.9 for NA.

1Due to the small sample, the North American and International indexes are based on a 3-month moving average. The June 2025 index is preliminary, based on the average of June and May 2025 and will be final with July 2025 data in the next report.

1AVIXA®, the Audiovisual and Integrated Experience Association, has published the monthly Pro AV Business Index since September 2016, gauging sales and employment indicators for the pro AV industry. The index is calculated from a monthly survey that tracks trends. Two diffusion indexes are created using the survey: the AV Sales Index (AVI-S) and AV Employment Index (AVI-E). The diffusion indexes are calculated based on the positive response frequency from those who indicated their business had a 5% or more increase in billings/sales from the prior month plus half of the neutral response. An index of 50 indicates firms saw no increase or decline in business activity; more than 50 indicates an increase, while less than 50 indicates a decrease.

The economy uncertainty is causing our clients to spend less on initial contracts and have been doing change orders just prior to their events. This has happened on three events so far in 2025

Live Events, North America

The economy is better, and the purse strings have been loosened so, we are designing projects again and picking out parts and materials

End user, North America

Growing sales funnel in both the MDU and single family home markets, lost another technician seeking a different employer but at the end of the month we are adding two to replace them. Business as usual with steady slow growth

Integrator, Asia-Pacific

Methodology

The survey behind the AVIXA Pro AV Business Index was fielded to 2,000 members of the AVIXA Insights Community between May 29, 2025 and June 6, 2025. A total of 299 AV professionals completed the survey. Only respondents who are service providers and said they were “moderately” to “extremely” familiar with their company’s business conditions were factored in index calculations. The AV Sales and AV Employment Indexes are computed as diffusion indexes. The monthly score is calculated as the percentage of firms reporting a significant increase plus half the percentage of firms reporting no change. Comparisons are always made to the previous month. Diffusion indexes, typically centered at a score of 50, are used frequently to measure change in economic activity. If an equal share of firms reports an increase as reports a decrease, the score for that month will be 50. A score higher than 50 indicates that firms, in the aggregate, are reporting an increase in activity that month compared to the previous month. In contrast, a score lower than 50 is a decrease in activity.

About the AVIXA Insights Community

The AVIXA AV Intelligence Panel (AVIP) is now part of AVIXA’s Insights Community, a research group of industry volunteers willing to share their insights on a regular basis to create actionable information. Members of the community are asked to participate in a short, two-to-three-minute monthly survey designed to gauge business sentiment and trends in the AV industry. Community members will also have the opportunity to participate in discussions, polls and surveys.

Community members will be eligible to:

- Earn points toward online gift cards

- Receive free copies of selected market research

- Engage directly with AVIXA's market intelligence team to help guide research

- Ask and answer other industry professionals' questions

The Insights Community is designed to be a global group, representative of the entire commercial AV value chain. AVIXA invites AV integrators, consultants, manufacturers, distributors, resellers, live events professionals, and AV technology managers to get involved. If you would like to join the community, enjoy benefits, and share your insights with the AV industry, please apply here